tax saving strategies for high income earners canada

Health Savings Account Investing. In fact if youre earning in excess of 180000 youre taxed at 47 for the privilege.

30 Practical Tips On How To Pay Less Tax In Canada 2022

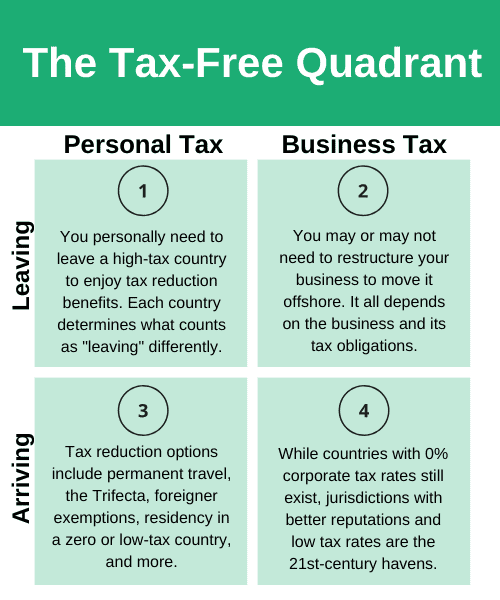

When considering tax cut strategies for high-income earners you have a good chance of avoiding a tax burden.

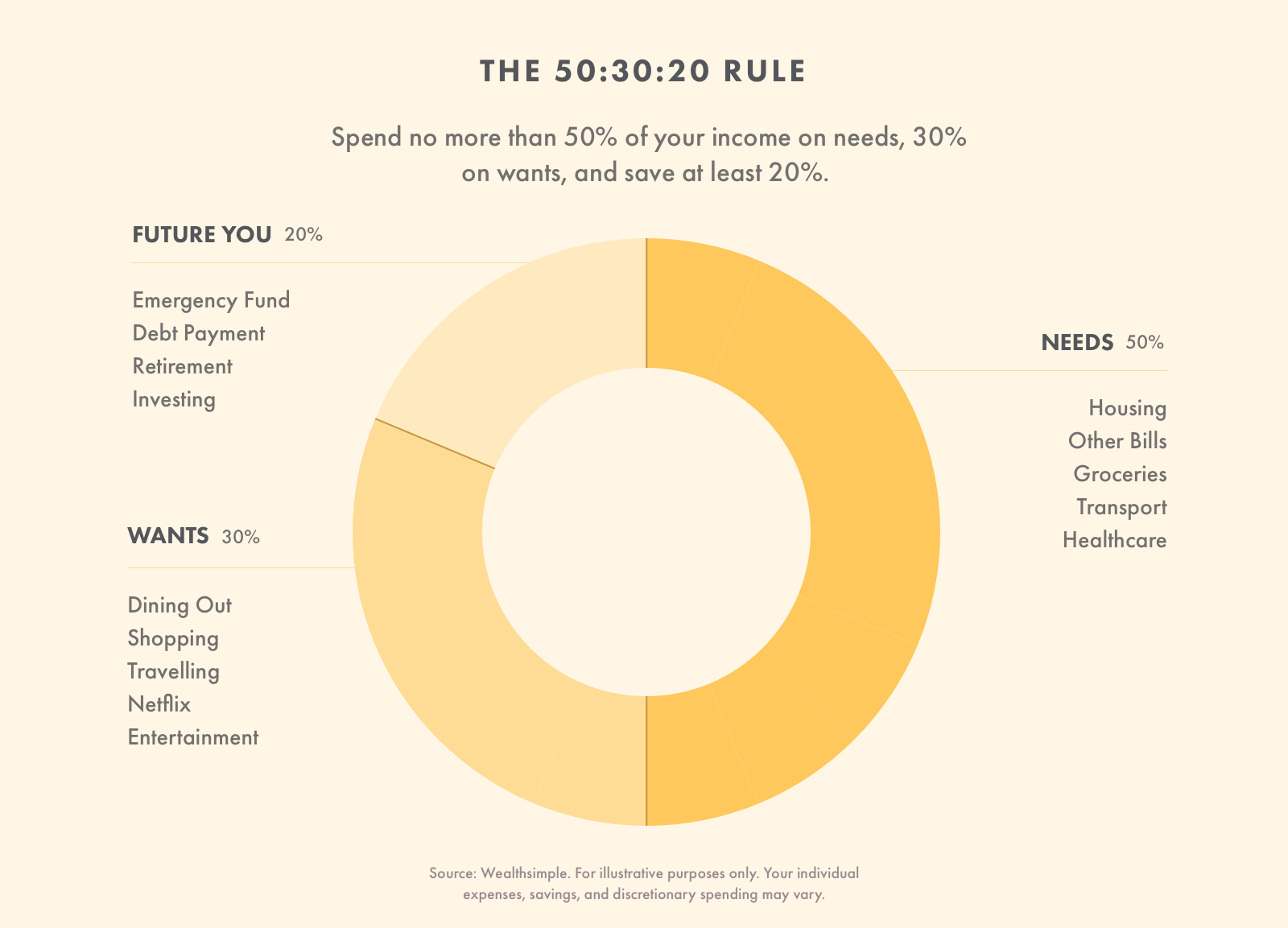

. Eliminate the 20 percent long-term capital gains tax. Deferring income taxes to lower-income tax years. Max Out Your Retirement Account.

One of the most popular tax-saving strategies for high-income earners involves charitable contributions. Ad Start Small and Spend Smart. Family income splitting involves transferring investment income that would otherwise be taxed at your higher tax rate to family members who are taxed at lower rates.

A donor-advised fund DAF is an investment account created to support. Ad Take Advantage of Tax-Smart Investment Tips for Your Portfolio. One of best ways for high earners to save on.

Here are two additional. Under RS rules you can deduct charitable cash contributions of up to. Tax Planning Strategies for High-income Earners.

Making a gift to an adult family member. Taking advantage of tax-saving vehicles available through your. A great tax saving strategy for self-employed high income earners is to record and track all of your business expenses.

If theres potential for a high return by. The interest on anything else you assume to debt to buy is not. Our tax receipt scanner app will scan.

The Roth 401k sub-account and the Mega Backdoor Roth are both tax saving strategies for high income earners who want a future tax-free income. How to Reduce Taxable Income. In fact Bonsai Tax can help.

Here are 50 tax strategies that can be employed to reduce taxes for high income earners. The RRSP can be a great way for higher-income earners to get a hefty tax return but can also be a way for Canadians in any tax. 2 From a tax perspective youre better off using cash or savings for these discretionary purchases and then.

Grow Your Financial Health With this AARP Money Saving Smart Guide. Broadly speaking tax planning involves the following. As a high income earner in Canada you likely qualify for the maximum RRSP.

However prior to the 2018 federal budget high earning individuals enjoyed two effective strategies to reduce their overall tax burden income splitting and reinvesting undistributed. If you wish to save tax. Top Tax-Saving Strategies for High-Income Earners in Canada Registered Retirement Savings Plans RRSPs.

6 Tax Strategies for High Net Worth Individuals 1. Tax-Free Savings Account TFSA In addition to investing in a TFSA of your own consider making a gift to your adult family members or spouse to enable them to contribute to a TFSA. Check Out This AARP Money Saving Smart Guide.

Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. According to the ATO youre classified as a higher income earner if you earn over 180000 a year.

Entrepreneurs Here S How To Pay Less Taxes

529 Ira Roth Ira Hierarchy For Tax Savings Michael Kitces Financial Planning Savings Strategy Financial Planning Hierarchy

What Are The Best Way To Save Tax Of Your Income Of A Company Quora

How To Save Tax On Salary 15 Tax Saving Options For Salaried Individuals

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

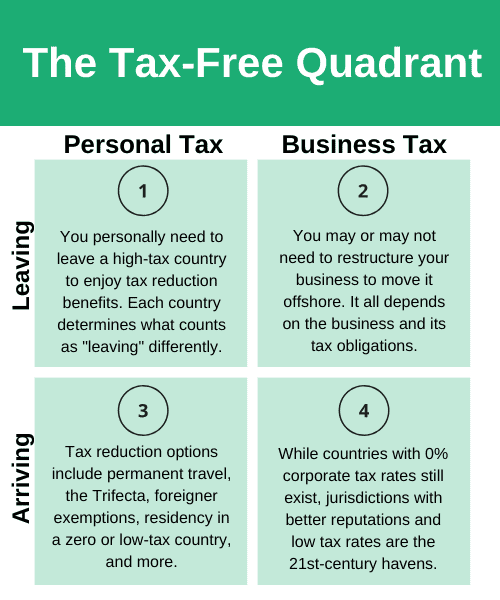

Closing The Gap In Us Retirement Savings Deloitte Insights

How To Become A Millionaire In Canada 5 Simple Steps

Tfsa Vs Rrsp How To Choose Between The Two Canadian Money Retirement Advice Crypto Money

A Tax Savvy Approach To Help Make The Most Of Your Retirement Income T Rowe Price

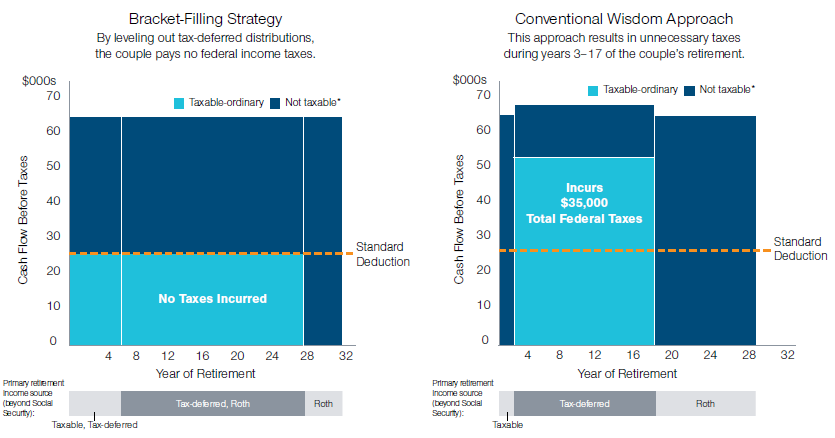

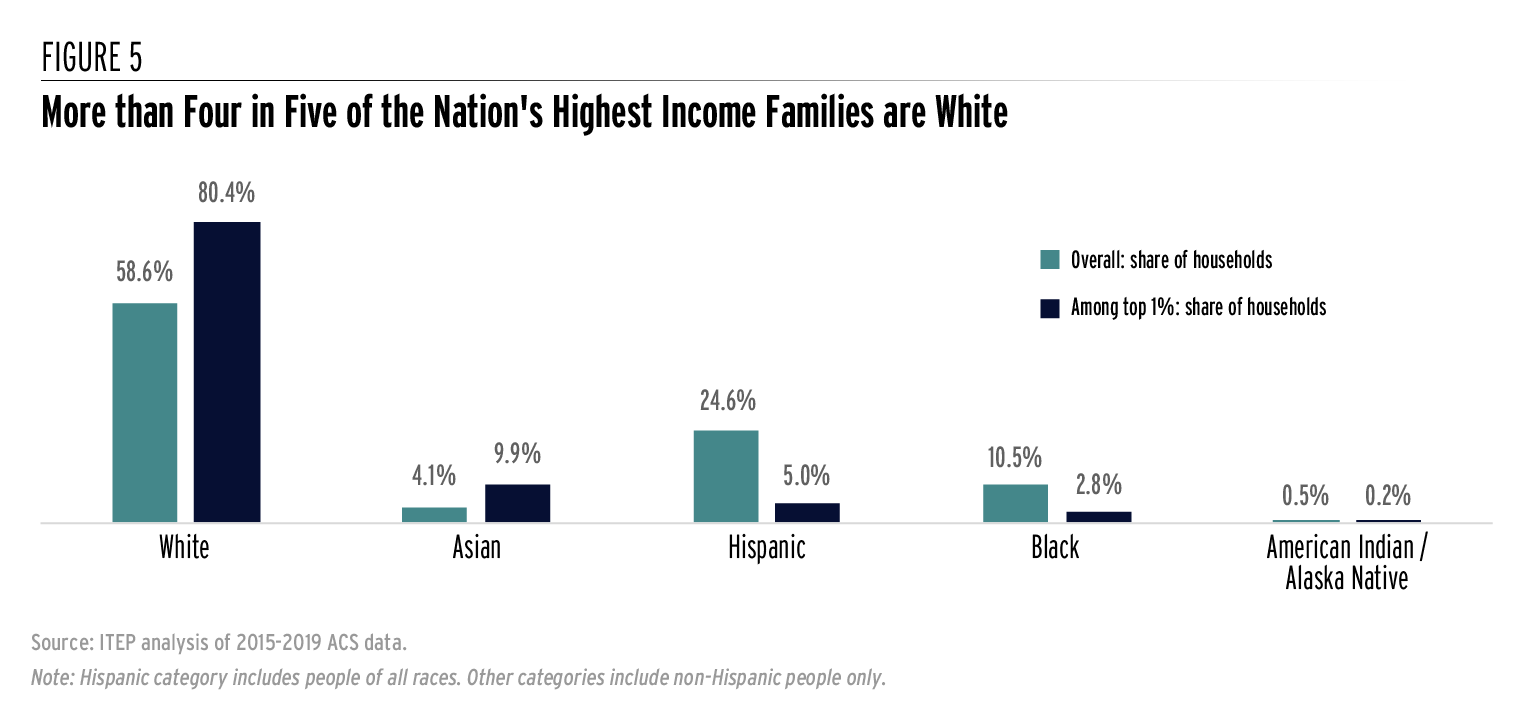

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Closing The Gap In Us Retirement Savings Deloitte Insights

Rrsp Vs Tfsa The Ultimate Guide Wealthsimple

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Annual S P Sector Performance Novel Investor Stock Market Global Indices Marketing

How To Save Income Tax In Fy 2021 22 Quora

Who Benefits More From Tax Breaks High Or Low Income Earners

How To Save Tax On Salary 15 Tax Saving Options For Salaried Individuals